There has never been, in my memory, such a creatively imaginative budget as that delivered today by Chancellor Darling, very different in character from budgets of Gordon Brown or Ken Clarke. Some UK broadsheet newspaper comment began with words such as boring and vacuous before finding items deserving of positive praise and some muted excitement. I am surprised.

There has never been, in my memory, such a creatively imaginative budget as that delivered today by Chancellor Darling, very different in character from budgets of Gordon Brown or Ken Clarke. Some UK broadsheet newspaper comment began with words such as boring and vacuous before finding items deserving of positive praise and some muted excitement. I am surprised.Many commentators said the budget is of marginal impact, steady as she goes. And yet David Cameron's attack centred on this budget doubling the government debt again, having already doubled it once since taking office. Not sure how he calculated that?

It is a sign of just how jaded and cynical the country has become, not just the government. The Gilts markets had primed themselves for a sell-off, helped by Portugal's sovereign downgrade. The stock market rose 1/2%, which means nothing.

It is a sign of just how jaded and cynical the country has become, not just the government. The Gilts markets had primed themselves for a sell-off, helped by Portugal's sovereign downgrade. The stock market rose 1/2%, which means nothing. Most media comment overlooked the raft of measures designed to help small businesses. There was general discounting of economic recovery as the main factor that will narrow the fiscal deficit and raised doubts about the realism of nearly £60bn of medium term spending cuts, especially the £11bn efficiency savings.(I have followed 30 previous budgets in detail looking for exciting changes, rarely finding anything sexy but plenty 'sexed up'.)

During the Chancellors's speech there was growing enthusiasm that rumbled more than cheered on the government benches. One political result is that it may have marked Alistair Darling at last as a giant of the Labour party that he has not been perceived as until now. Ed Balls could not have achieved that much even had he been Chancellor in place of Darling. Darling was quite daring in saying that if the budget deficit had not grown and government not intervened the revenue losses would have been much greater and the deficit consequently even wider! This was a telling point that went unchallenged in the debate? Government budget is roughly 45% ratio to the economy, but its share of GDP is really close to only 20%. It also needs to run a deficit just to generate Gilts to feeds the needs of banks, insurers and other finance sector needs, which currently are very high as they seek to improve the quality of their capital and liquidity reserves - but Darling did not say that; he should have!

During the Chancellors's speech there was growing enthusiasm that rumbled more than cheered on the government benches. One political result is that it may have marked Alistair Darling at last as a giant of the Labour party that he has not been perceived as until now. Ed Balls could not have achieved that much even had he been Chancellor in place of Darling. Darling was quite daring in saying that if the budget deficit had not grown and government not intervened the revenue losses would have been much greater and the deficit consequently even wider! This was a telling point that went unchallenged in the debate? Government budget is roughly 45% ratio to the economy, but its share of GDP is really close to only 20%. It also needs to run a deficit just to generate Gilts to feeds the needs of banks, insurers and other finance sector needs, which currently are very high as they seek to improve the quality of their capital and liquidity reserves - but Darling did not say that; he should have! What is somewhat galling about the debate and media comment on the budget is the idea hat he only elephant in the room is government debt and borrowing. But that is only one quarter of the debt overhang in the UK economy. To cope with that we need to see some of it shifted from private sector shoulders onto the government's back - that is not dogma, just realism.

GDP ESTIMATES

GDP ESTIMATESThere was much debate in the House of Commons and in the media about the reliability of the Government's GDP estimate of over 3% for 2010 and 2011. The unrecognised fact is that first, UK growth is very closely dependant on US economic growth, and second, that consensus forecasts are always wrong.

The forecasting errors have been relatively trivial until 2008-2009 when large error crept in should not be surprising. In exceptional years of recession we can never trust governments to predict the depth of recession publicly for fear of thereby deepening the recession by negatively influencing expectations. Otherwise, the Treasury's forecasts have been as accurate as anyone should expect.

The forecasting errors have been relatively trivial until 2008-2009 when large error crept in should not be surprising. In exceptional years of recession we can never trust governments to predict the depth of recession publicly for fear of thereby deepening the recession by negatively influencing expectations. Otherwise, the Treasury's forecasts have been as accurate as anyone should expect.  Roughly it will take the economy 7 years from 2008 to achieve the level of output it would have expected to reach in 4 years. Pre-2008 is an output trend based on a property and asset based credit-boom growth. The Opposition parties skirt around 'credit-boom' - it is not in the political lexicon. They merely express something in that direction when they refer to an 'overblown finance sector'.

Roughly it will take the economy 7 years from 2008 to achieve the level of output it would have expected to reach in 4 years. Pre-2008 is an output trend based on a property and asset based credit-boom growth. The Opposition parties skirt around 'credit-boom' - it is not in the political lexicon. They merely express something in that direction when they refer to an 'overblown finance sector'. EXTERNAL TRADE & COMPETITIVENESS

At he same time here is acknowledgement that 'finance' is a major competitive advantage sector of the UK economy'S competitiveness. But, however well that sector performs and recovers, the UK economy must seek to change its growth strategy and focus more on industry, on what will narrow the trade gap even if the result is only to hold the deficit steady. There is a risk of the deficit widening dramatically with a sharp deterioration in current account for reasons that will become clear when discussing the budget debate below, especially the issue of banking lending.

In most years, budgets are only interesting in the macro-economic details they provide in the Budget's Red Book, little of which is normally discussed in the main Speech, though not this time. The Red Book is the UK Government's only fulsome statement of economic policy. We do not have the equivalent of the USA's President's Council of Economic Advisor's report to Congress.

In most years, budgets are only interesting in the macro-economic details they provide in the Budget's Red Book, little of which is normally discussed in the main Speech, though not this time. The Red Book is the UK Government's only fulsome statement of economic policy. We do not have the equivalent of the USA's President's Council of Economic Advisor's report to Congress.The key issue is noted in page 177 of the Red Book:"There is a risk that the future supply of credit is constrained by concerns over the availability of bank funding and the cost of refinancing existing funding [of funding gaps = about 1/3 of banks' balance sheets] following the collapse of the shadow banking system and the general repricing of risk. The authorities will continue to monitor developments in funding markets as banks continue to restructure their balance sheets and reduce their reliance on short-term wholesale funding."

The fact is that funding costs have not yet come down to a level that makes expanding business lending profitable for the banks! The banks do not say so and instead claim that lower lending is a result of the speed and extent of private sector deleveraging, while their own deleveraging is merely described as 'tighter credit conditions'.

PRIVATE SECTOR DEBT

PRIVATE SECTOR DEBTTo take the pressure off so much political focus on government deficit and debt, Darling and the red Book could have said a lot more about private sector borrowing and debt. The minimum was said? The Red Book says that, "The level of household debt rose substantially in the last decade, as households mainly used debt to finance house purchase and other assets. Household balance sheets have weakened in the recession due to falling asset prices, which has served to lower the ratio of net assets to income. These factors, together with the tightening of credit conditions and past increases in asset price volatility, may have contributed to the significant adjustment already under way, as demonstrated by the sharp rise in the saving ratio in 2009."

Deposit savings have risen but not as fast as interbank lending, especially cross-border has shrunk such that the £800bn funding gap of the UK banks has not narrowed other than the liquidity measures (e.g. SLS and APS) of the Bank of England and HM Treasury. The general rise in private saving is a mirror of the increase in government borrowing, which remained flat in ratio to GDP for a decade while private sector borrowing doubled and tripled, but mainly to lend to property, mortgages and finance sector i.e. based on asset prices and unearned income.

Traditionally, in the Red Book there was a graphic showing how private savings and government net borrowing match each other in ratio to GDP. Since Labour came to power in 1997 that chart has been left out, which may have a little to do with subsequent confusion about the positive relationship between government debt and the saving in the economy, which is contrary to most people's intuitive assumption. this is an accounting identity of the balance between private and public; the more one side borrows, the more the other side saves. The banking crisis forced the private sector to save, partly by denying credit and partly by inducing a recession. Increased government borrowing and its counterpart increased private saving both can look like a cause of recession, of reduced tax revenues and increased pressure on government to loosen fiscal policy to cushion the economy.

Therefore Chancellor Darling's reference to higher private savings does not tell us much until the private sector continues saving and banks deny credit requiring government to borrow even more - hoping to reverse this is why government is now neutralising its fiscal stance. But, it is dangerous if government tries to drastically cut borrowing suddenly as long as the private sector is fixed on saving and banks on shrinking their loanbooks, when cutting public borrowing will only depress demand. Only when firms, households and banks regain capacity to borrow and invest that government can reduce its deficit.

THE BUDGET SPEECH

Budget speeches in non-recession years mainly only report marginally adjust tax rates and transfers in the main speech. Partly because of the credit crunch recession, the imminent general election, and as the first Budget where Alistair Darling could make it fully his own, he went quite far in setting manifesto policy - it may, of course, be Darling's third and last budget and much of what it promises may be changed by a new incoming government. If the government party changes, there are some signs that the precedent set by labour in 1997 of adhering to the preceding government's budget-setting for 2 years, on the tax changes at least - if not, I hope Labour is re-elected for another term.

HOUSE OF COMMONS

HOUSE OF COMMONSThe Opposition Leader David Cameron responded with more sarcastic and satirical, enthusiasm, desporting an energy and passion, than I recall witnessing before in response to a budget statement! Many Labour MPs departed the chamber rather than listen to him. Where do they go? - perhaps to speak to journalists, others to write valedictories on their web-sites or to read the Red Book, and some just nowhere special such as their desks, knowing that whatever the results of the next election they are out of politics?

HoC members are not well versed in budget and treasury matters, even less so about economics. If the number of members left to debate is an indicator of macro-economic literacy among our Commons parliamentarians, then there is much to be hoped for in the turnover of MPs awaited at the soon to be announced General Election.

Following Cameron's reply, before Nick Clegg could rise to speak for the UK's third party, most of the Labour benches cleared out, which was a vote perhaps against the prospect of an alliance should there be a hung parliament, or simply insulting?

After Clegg spoke only 7 Labour members including The Chancellor and two of his deputies remained in the chamber compared to about 40 members on the opposition benches, which then too slowly thinned as The Chairman of the HoC Treasury Committee spoke - his last speech before retiring from The Commons.

The ensuing debate was tedious and of trivial import, while the Budget speech was wholly absorbing and the Opposition's riposte electrifying. The next day's debate, once key front-benchers departed was again reduced to only 30 members, 15 on either side of the house - a very poor showing that can only undermine those who exalt the importance of back-bencher debate. Bt 5pm on Thursday the number of members of parliament debating the budget had fallen to no more than 10!

The main figures are:

GROWTH FORECASTS

GROWTH FORECASTSThe budget speech declared that growth forecasts remain fairly intact with only a small downward revision for 2010's GDP growth, which will still exceed 2-3 times last year's of about 1%. Budget deficits will halve in 4 years helped by expenditure savings of £11bn without harming frontline services, assets sales of £16bn, £11bn in feees and bonus taxes from banks, and another over £60bn in medium term expenditure savings, plus some tax rises (without as the Opposition pointed out, mentioning £4bn in 'stealth taxes' i.e. rises announced in past budgets that only come into effect this year) and reducing tax evasion of which 60% will impact the top 5% and 1% highest income earners.

Corporation tax (a quarter of which came from financial services), which was the main fall in government revenue, will remain at the lowest rate among G7 countries and national debt among the lowest in the EU and no more than the G7 average. He said that government gross borrowing between now and 2014 will be £100bn less than previously forecast. This and other related information provided should take a lot of the air out of the political tyre pressure for spending cuts.

PROFIT FROM SAVING THE BANKS

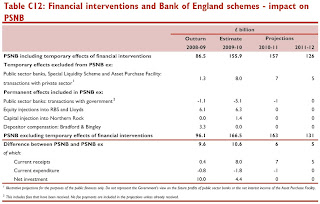

PROFIT FROM SAVING THE BANKSIt is puzzling why no firmer estimates, even within a wide band, can be forecast for the £tens of billions of future revenue from not only selling equity in RBS and LBG, currently worth £40bn, but also income from asset swaps and fees - just as no mention of the £200 billion of bought-in gilts and other gilts held internally to government, and tax on that, which greatly reduce the budget's net debt interest cost by half. George Osborne for the Opposition picked up on what several MPs said in the Commons that debt interest exceeds expenditure on education, which is madness - er, um, it doesn't? Gross debt interest is £10bn less, but the same as Defense, but net debt interest is much smaller, about half.

NON-TAX INCOME OFF BUDGET OFF BALANCE SHEET

Chancellor Darling referred to £8bn recovered in fees from banks and £2.5bn on taxing bank bonuses. The £8bn came from RBS and LBG in respect of the Asset Protection Scheme (APS), and other items? (The APS took £282bn off RBS's balance sheet in addition to about £275bn taken off banks' balance sheets via the SLS). Among assets for sale (The Tote and Dartford Tunnel) no mention was made of the expected sale of Northern Rock with £10bn mortgages and £19bn deposits. From the sale of B&B and NR, and the nationalised bad bank of NR and B&B impaired assets the government expects to recover £50bn. The roughly £400bn of bank assets there must be an annual income of at least £15bn. The total of these incom and sales items medium by 2012 generate £100bn government revenues.

The Opposition parties accuse the government of dishonesty over the deficit and expenditure cuts. But, they are not addressing how it is that the government has made £hundreds of billions of interventions with the banks without any of that being on budget.

The government cannot openly predict the returns from sale of equity in the banks and the precise repo swap net income on banks' assets, which may simply be used to pay down national debt. It is under-appreciated that all the help to bail-out banks has been off-budget, off-balance sheet with a negative actual current expenditure. The Red Book only makes this vaguely clear in pages 211-216.

The government cannot openly predict the returns from sale of equity in the banks and the precise repo swap net income on banks' assets, which may simply be used to pay down national debt. It is under-appreciated that all the help to bail-out banks has been off-budget, off-balance sheet with a negative actual current expenditure. The Red Book only makes this vaguely clear in pages 211-216.  The government has a large ownership of banks worth more than £1 trillion of a balance sheet where assets and collateral exceed liabilities by about £700 billions -hardly a situation of difficulty. The government is reluctant to be transparent about this because options remain open as to how much profit to reap before letting private investors and private wholesale funding providers back in.

The government has a large ownership of banks worth more than £1 trillion of a balance sheet where assets and collateral exceed liabilities by about £700 billions -hardly a situation of difficulty. The government is reluctant to be transparent about this because options remain open as to how much profit to reap before letting private investors and private wholesale funding providers back in.  EMPLOYMENT & UNEMPLOYMENT

EMPLOYMENT & UNEMPLOYMENTDarling introduced a raft of measures to support small business, R&D, education and training, and took pride in more than 1 million fewer jobs lost compared earlier recessions (at 1.6m claimant count) that was met with loud guffaws on Opposition benches who believe the true unemployment figure is 1 million higher? But nearly 200,000 are being kept off the claimant count by £1bn spent on sponsored employment experience for education leavers. Insofar as darling's claim is true, it is a remarkable feat mostly ignored by media comment. The UK's recessions (except for 2001, the only time boom-bust was smoothed over) almost always exactly follow that of the USA very closely. In the USA unemployment is more severe than earlier recessions, while the UK is claiming this time the opposite to be the case? USA unemployment is shown below:

UK employment, whether the figures have been flattered, nevertheless continue to show a high participation rate and employment of over 70%, and it has to be a fact that the claimant count is lower than expected, if lower for 'stealth' reasons than it should be?.

UK employment, whether the figures have been flattered, nevertheless continue to show a high participation rate and employment of over 70%, and it has to be a fact that the claimant count is lower than expected, if lower for 'stealth' reasons than it should be?.

SMALL BUSINESS

SMALL BUSINESS2.7m small firms employ half of UK private sector jobs (in USA the number is 27m small firms). UK small firms employ as many jobs all 32,000 large companies. Among help for small business, rates will be zero for 300,000 small businesses that The Chancellor said employ 1.6 million and rates discounts for other small firms should benefit these firms by about £1,000 each. RBS and LBG are being told to lend £94bn in new business loans in 2010-11 half (actually £105bn of which £41bn) must go to small firms and SMEs. When only 6.5% of all customer lending by all UK banks goes to small businesses that employ 13.5 millions this item in the budget report may appear trivial. He also announced creation of a Small Business Credit Adjudicator with statutory powers to enforce judgements. The Adjudicator will work closely with an expanded Financial Intermediary Service to ensure that small businesses are treated fairly when applying for loans. There are in the UK more than 2.5 million small businesses of which 1 million borrow from banks on a business loan basis. If even 10% of these have complaints the FIS will have its work cut out!

INFRASTRUCTURE

INFRASTRUCTUREThere was £250m to mend potholes and improve motorways amid remarks about infrastructure for trade, but nothing, as two MPs noted, about public sector or low income housing. The BBC calculated that UK's potholes in roads needs £9 billions to mend and that the government's 3100m for this will not fill many of these holes, which has now become a metaphor for mending holes in the budget!

Darling's alternative to doing anything on social housing is only to sharply raise the threshold for housing stamp duty threshold for first time buyers (a proposal that the Opposition claim to have proposed first) while putting it up to 5% for £1+ million homes from 2011 (which the Opposition does not claim credit for).

Cameron in his comments claimed several times that UK business is stuck, nothing moving, and that half of UK adults of working age are economically inactive! This is rhetoric since UK's participation remains high at nearly 70%.

One very valid point Cameron made is that the budget speech neglected tax rises already in the pipeline (£4bn 'stealth taxes). Cameron mentioned the postponed (but now due) higher business rates that will impact some key businesses. Cameron did not mention that universities are due to lose $1 billion. But what government takes away in one hand often gives back directly with the other; universities can compete for a quarter billion special funding, and there was a lot of support for small businesses, though not all of it easy to quantify or time.

BANK LENDING TO SMALL BUSINESS

BANK LENDING TO SMALL BUSINESSTo aid small businesses, Darling said £billions of government procurement would be routed to small firms, including invoices paid within 5 days (1 week) and making the major banks RBS and LBG, who cover half of domestic lending, make £90bn in new loans to small and medium sized firms especially plus several peripheral initiatives to secure this including a small business loans ombudsman service.

Clegg rightly pointed out that new gross lending is not the same as net lending increase. In the last year when £12bn and £15bn in net new lending to small firms was insisted upon by RBS and LBG, their general customer lending fell by about 8% or roughly over £60bn, despite new lending of £79bn as confirmed by a Treasury Minister who also claimed that the promised £94bn for new lending in 2010-11 would be a substantial economic benefit.

Darling also said these banks are half of the UK bank lending market, actually 40% is closer to the true figure. There is some confusion. Total UK banks' small firm and SME lending is only £220bn of which £100bn is mortgages. LBG and RBS have only 25% of this lending. If the two banks do authorise £94bn in new loans as Darling said, though the Red Book says £105bn, half to UK SME and small firms will this have a positive net effect? The Red book says £41bn of new loans or small businesses.

The two banks currently have £79bn outstanding to small firms and SMEs of which £35m are longer term corporate mortgages. That suggests that in the year £112bn was cancelled and £44bn new loans granted. If these loans are renewable annually as is normal and only £41bn new loans made to small businesses then these two banks lending to small businesses could shrink by £3bn! The banks say they are not refusing loan requests more than by the usual 15%.

I wish that all of the £105bn would allocated to small businesses and then there could be a rise of £21bn, which nevertheless remains trivial in terms of these banks' balance sheets. The two government controlled/influenced banks should make another £100m of new loans to bigger business. Either way, Clegg's point is made that obliging firms to authorise new loans gross does not guarantee a net positive effect? The Chancellor and his deputies have emphasised that these are "new" loans. They may not appreciate that almost all customer loans are renewed annually except mortgages.

Chancellor Darling also announced a new UK Finance for Growth investment corporation and a New growth Capital Fund with £500m.

The business support proposals in the budget may be those proposed by Lord Mandelson, the Business Secretary, who in January announced plans to guarantee as much as £20bn of bank loans to small and medium-sized companies to ensure credit keeps flowing. There was no further mention of this. It is to apply to companies with sales of up to £500m will be able to qualify for the support, which covers a wide range far above that of the standard definition of small firms. He said, "UK companies are the lifeblood of the economy, and it is crucial that government acts to provide real help". It strikes me that there has been a looseness with detailed definitions. Maybe these will become clear in the legislation?

The business support proposals in the budget may be those proposed by Lord Mandelson, the Business Secretary, who in January announced plans to guarantee as much as £20bn of bank loans to small and medium-sized companies to ensure credit keeps flowing. There was no further mention of this. It is to apply to companies with sales of up to £500m will be able to qualify for the support, which covers a wide range far above that of the standard definition of small firms. He said, "UK companies are the lifeblood of the economy, and it is crucial that government acts to provide real help". It strikes me that there has been a looseness with detailed definitions. Maybe these will become clear in the legislation? OPPOSITION PERFORMANCE

OPPOSITION PERFORMANCECameron was exuberantly rhetorical about the government's economic growth forecasts including repeating again that growth recovery will come from cutting deficit spending sooner not later.

In direct response to Darling saying that the financial crisis and recession began in the USA, Cameron later claimed the UK was first into recession and last out, implying it all started in the UK, as he tried to repeat in various rhetorical ways? He said that the government's borrowing is greater in one year than in all previous Labour deficits summed together and claimed that what Labour has done to the economy is the damage that Labour always delivers. This is untrue in either cash amounts or in current values, but must be derived from some synthetic analysis. He also castigated the government for relying on growth figures (over 3% GDP growth in 2011) above that of consensus forecasts.

But, as any economist knows, and he should know, independent forecasts offer a wide range and the consensus value is invariably wrong (2.1% for 2011). This is part of the Conservative Policy case for a quasi-independent Office for Budgetary Responsibility to monitor Treasury modeling. I suspect this is a copy of the US Congressional Budget Office that I find infused with think-tank dogma producing severely error-ridden forecasts.

But, as any economist knows, and he should know, independent forecasts offer a wide range and the consensus value is invariably wrong (2.1% for 2011). This is part of the Conservative Policy case for a quasi-independent Office for Budgetary Responsibility to monitor Treasury modeling. I suspect this is a copy of the US Congressional Budget Office that I find infused with think-tank dogma producing severely error-ridden forecasts. Cameron offered IMF and European Commission as evidence for the government's deficit reduction being to slow. He also made great play of a couple of survey findings that the UK has fallen from 4th to 84th and 86th in tax and regulation burden in world rankings. This is obtuse on both counts - political points-scoring coat-trailed by George Osborne on 8th Feb. - see http://www.egovmonitor.com/node/33416

The accusation was again levelled by Cameron that the UK government is responsible for the recession and that its spendthrift ways of seeking to get the economy out of recession exhibits the same quality of economic management as that of financial services - a theme that caused much merriment on his side of the House. The implication here is that the finance sector in the UK became 'overblown', a term used in speeches by Shadow Chancellor Osborne, and by Nick Clegg in his response to the budget speech on behalf of Liberal Democrats. The Finance Sector is 5-8% of GDP depending on definitions, but has been 25% of corporate profits, and actually supports about 20% of all jobs in the economy indirectly as well as directly, as many as government. We may not advantage the rest of the economy by shrinking the finance sector? It is undoubtedly an important part of our total economy's size.

The accusation was again levelled by Cameron that the UK government is responsible for the recession and that its spendthrift ways of seeking to get the economy out of recession exhibits the same quality of economic management as that of financial services - a theme that caused much merriment on his side of the House. The implication here is that the finance sector in the UK became 'overblown', a term used in speeches by Shadow Chancellor Osborne, and by Nick Clegg in his response to the budget speech on behalf of Liberal Democrats. The Finance Sector is 5-8% of GDP depending on definitions, but has been 25% of corporate profits, and actually supports about 20% of all jobs in the economy indirectly as well as directly, as many as government. We may not advantage the rest of the economy by shrinking the finance sector? It is undoubtedly an important part of our total economy's size. DARLING STATEMENTS

DARLING STATEMENTSDarling said the government would sell its equity stakes in the banks and that 900 branches would be sold off and more competition encouraged. All this does bode for further break-up of the biggest UK banks? He wants to establish a green investment bank to fund alternative energy developments, various tax breaks for use of UK registered patents, higher tax thresholds for small firms and pensioners. Darling said that state pensions have doubled since 1997 to a variously conditional guaranteed £132pw and that these would increase somewhat above inflation, which is almost good news if in reality very muted and tentative (far short of the reality that state pensions are 40% below their 1950s value) for impoverished pensioners, but not something anyone in the debate picked up on.

REDWOOD'S BIGGER PICTURE

REDWOOD'S BIGGER PICTUREJohn Redwood MP claimed the government grossly underestimated the size of the economy it is dealing with (an hour and a half after the chamber nearly emptied), saying that the budget's stimulus is only £1.4bn in a £1.4tn economy! How he arrives at this is a total mystery - he is stepping way out on a limb to imply that deficit spending at 12% ratio to GDP has no significant effect? This shocked me, but indeed on a cyclical basis it is confirmed by the Budget Red Book!

The graphic is accompanied by obeisance to the Growth and Stability Pact (Maastricht Criteria), "The UK is subject to the Stability and Growth Pact (SGP) as part of its membership of the European Union (EU). Treaty obligations require the UK to endeavour to avoid excessive deficits, defined as 3% of GDP on the Treaty deficit measure. The UK is not subject to sanctions or corrective measures if it does not comply. Twenty-one EU member states are currently subject to the Excessive Deficit Procedure of the SGP. EU leaders have agreed that the flexibility provided for in the SGP should be used, and that fiscal consolidation should be undertaken in line with economic recovery. The EU’s Economic and Financial Affairs Council has recommended that the UK bring its Treaty deficit below the 3% reference value by 2014-15... the Government has taken a judgement on the appropriate pace of fiscal consolidation, consistent with its fiscal policy objectives. The annual pace of consolidation for the UK set out in Budget 2010 is the fastest in the G7 on IMF forecasts for the period up to 2014."

The graphic is accompanied by obeisance to the Growth and Stability Pact (Maastricht Criteria), "The UK is subject to the Stability and Growth Pact (SGP) as part of its membership of the European Union (EU). Treaty obligations require the UK to endeavour to avoid excessive deficits, defined as 3% of GDP on the Treaty deficit measure. The UK is not subject to sanctions or corrective measures if it does not comply. Twenty-one EU member states are currently subject to the Excessive Deficit Procedure of the SGP. EU leaders have agreed that the flexibility provided for in the SGP should be used, and that fiscal consolidation should be undertaken in line with economic recovery. The EU’s Economic and Financial Affairs Council has recommended that the UK bring its Treaty deficit below the 3% reference value by 2014-15... the Government has taken a judgement on the appropriate pace of fiscal consolidation, consistent with its fiscal policy objectives. The annual pace of consolidation for the UK set out in Budget 2010 is the fastest in the G7 on IMF forecasts for the period up to 2014." The early reduction in fiscal stimulis is possibly a sop to the EU or to the financial markets, but if Bill Cash and other Euro-sceptics on his side of the house were not fiscal conservatives this would make their blood boil. For mixed reasons it rightly angers John Redwood.

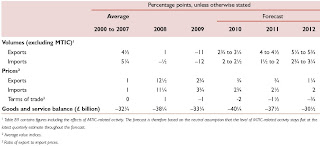

TRADE & CURRENT ACCOUNTS

TRADE & CURRENT ACCOUNTSThere was no discussion of the UK trade and current account, which is a serious matter from a sovereign risk perspective. There has been a third narrowing in the trade deficit to about 3% ratio to GDP and a much smaller current account due to net gain in financial services. The external accounts of the UK have been ignored by the government for more than a decade in line with the lack of discussion about the UK's credit-boom economy and in line with similar blinkered fashion prevailing in the USA. But, given the discussion about this is respect to Greece, Portugal, Spain and now the UK, it seems a gross negligence not to discuss the matter and show what improvement is being achieved.

The high trade deficit that was has shrunk in part due to sterling's depreciation and the profit to UK banks when liquidating net foreign assets. But, the cause of the trade deficit being due to UK manufacturing and export industries being relatively denuded of finance, of bank loans and trade finance, as well as the credit-boom stance of the economy that favoured property above all else, has not been addressed by the budget or the debate about the budget and the government's economic policy, or indeed by policy emerging in either of the major Opposition parties. Industry (production including manufacturing) is 16% of GDP and delivers 80% of UK exports. It gets 5% of customer lending (excluding loans to finance sector) by banks! Construction is 8% of UK GDP and gets about 20% of customer lending! The Budget forecast expect a large rise in capital investment including by business that in turn includes PFI projects (i.e. construction).

The high trade deficit that was has shrunk in part due to sterling's depreciation and the profit to UK banks when liquidating net foreign assets. But, the cause of the trade deficit being due to UK manufacturing and export industries being relatively denuded of finance, of bank loans and trade finance, as well as the credit-boom stance of the economy that favoured property above all else, has not been addressed by the budget or the debate about the budget and the government's economic policy, or indeed by policy emerging in either of the major Opposition parties. Industry (production including manufacturing) is 16% of GDP and delivers 80% of UK exports. It gets 5% of customer lending (excluding loans to finance sector) by banks! Construction is 8% of UK GDP and gets about 20% of customer lending! The Budget forecast expect a large rise in capital investment including by business that in turn includes PFI projects (i.e. construction). CAPITAL INVESTMENT

In the 2009 Budget capital investment was said to have grown sharply and expected to continue at high levels. Instead it fell by a third in manufacturing and generally by over a quarter. It had been about 3% of GDP. In extreme comparisons with trade surplus countries, in Germany industry is 30% of GDP and capital investment is 17% of GDP, and China capital investment is an extremely high 40%. It is obvious that capital investment correlates with similar percentages in bank lending relative to GDP. If business capital investment is to grow at 10% per annum it will scarcely add to UK competitiveness. Capital investment in industry and manufacturing needs to be at least 10% of GDP.

REDWOOD ON BANKS BALANCE SHEETS

REDWOOD ON BANKS BALANCE SHEETSJohn Redwood reported that RBS slimmed its balanced sheet by over £700bn, and LBG somewhat similar on a more modest scale of £100bn of which £50bn in customer loans, which while not all the balance sheet slimming is in UK loans it does denude credit liquidity for business borrowers. He could have said that banks cutting back their lending negates the government economic reflation efforts.

He did say however that evidence suggests that the banks are refusing to lend i.e. it is not only customers' deleveraging. He did not say that RBS's balance sheet shrinkage is £282m moved off balance sheet into the government's APS and nearly all the rest is netting off derivatives with no effect on customer loans.

He did say however that evidence suggests that the banks are refusing to lend i.e. it is not only customers' deleveraging. He did not say that RBS's balance sheet shrinkage is £282m moved off balance sheet into the government's APS and nearly all the rest is netting off derivatives with no effect on customer loans. The facts are that customer loans by RBS did fall including in the UK, but by less than £15bn. But all banks have shrunk UK customer loans to businesses last year by about £70bn or 5% ratio to GDP! And, only 5% ($100bn) of business lending goes to UK export businesses compared to 16% in Germany ($620bn).

Redwood said the banks have been broken and are being nursed back to health in a way that shrinks lending not expands it. So far, he is quite right about that.

Redwood said the banks have been broken and are being nursed back to health in a way that shrinks lending not expands it. So far, he is quite right about that. BANKING REGULATIONN

Redwood also claims that there is too much regulatory tightening at the bottom of the cycle when the capital requirements should be relaxed! But, actually it is not capital tightening but funding gap tightening and the high cost of refinancing funding gaps that has squeezed business lending - because it cannot be grown profitably. He says the boom was caused by weak banking regulation and the bust caused by over-regulation bringing on bank-bust and recession, a "violent cycle", "punk monetarism", "cheap money for government own uses", "starving the private sector of money", brought about by changing the structure of banking regulation and mismanaging the banking cycle.

My own UK banks' business lending data for end 2009 is shown below.

THE BIG ISSUE

THE BIG ISSUEThe problem for both Bank of England and FSA is that they do not have macro-economic models with which to assess the impact of changes in banks' balance sheets and the economy! The Bank of England is seeking to rectify this, but it will take maybe another 2 years' work!

In general the private sector has not been denied bank credit - private sector was showered with money, but not those parts most important to the UK's external account about which nothing was said in the budget, a point noted by at least two MPs. The Red Book provided a table that shows a rapid return to trade deficits only slightly less than before 2008. The government's help for industry and small business, and the twenty times that Chancellor Darling used the word "support" in his speech, does not extend to recognising that we cannot simply return to a credit-boom economy and must now focus more on putting some effort behind exports. The Red Book expectations are negligent of he UK's trade deficit and the wholly inadequate financing compared to what is necessary to secure the UK's competitiveness.

It becomes even more important when net transfers and net foreign incomes, including possibly FDIs, are expected to dry up?

It becomes even more important when net transfers and net foreign incomes, including possibly FDIs, are expected to dry up? The private sector was not denied credit borrowing; it grew threefold in a decade. The economy was heavily dipped in credit-boom growth. But, Redwood only adverted to that in terms of government letting banks balloon their balance sheets - but this was 70% in mortgages, most of the rest of loans being to finance sector - plus a lot of balance sheet assets in derivatives. Productive small firms and exporters were denuded of bank credit, small businesses as always, only 40% of which even have bank borrowings, though not SME property firms.

The private sector was not denied credit borrowing; it grew threefold in a decade. The economy was heavily dipped in credit-boom growth. But, Redwood only adverted to that in terms of government letting banks balloon their balance sheets - but this was 70% in mortgages, most of the rest of loans being to finance sector - plus a lot of balance sheet assets in derivatives. Productive small firms and exporters were denuded of bank credit, small businesses as always, only 40% of which even have bank borrowings, though not SME property firms.There can be little doubt that banks' lending to businesses, however small in their balance sheets (scandalously small) has been pro-cyclical and placed the full onus thereby onto Government to alone pull the economy out of its hole.

The Bank of England and the government are not overtly empowered to change that - only now, and only in the case of 2 big banks. In the past, however, it is true that The bank of England could have strongly advised banks generally to reduce mortgage and property exposure and otherwise restructure their balance sheets. It did not exercise this under its continuing responsibility for systemic banking risk and did not hink it proper to do so in the name of systemic risk to the whole economy! We can see how for a long period the contribution to UK growth of production industry has been so small notwithstanding that the economy relies on it for its major contribution to the economy's trade and current account.

The Bank of England and the government are not overtly empowered to change that - only now, and only in the case of 2 big banks. In the past, however, it is true that The bank of England could have strongly advised banks generally to reduce mortgage and property exposure and otherwise restructure their balance sheets. It did not exercise this under its continuing responsibility for systemic banking risk and did not hink it proper to do so in the name of systemic risk to the whole economy! We can see how for a long period the contribution to UK growth of production industry has been so small notwithstanding that the economy relies on it for its major contribution to the economy's trade and current account.  EXTERNAL BALANCES

EXTERNAL BALANCESThe issue of external balances in the world did not get raised until after 4pm by Michael Jacks MP (Con) in his last speech in The Commons. He is an ex-Treasury Minister and said that in a global world there has to be agreement on reducing the extreme imbalances. He also welcomed the government's measures for small firms, employment, stamp duty for first time buyers. He then asked the interesting question: where the £80bn in halving the deficit will come from out of the economy. He sensibly said that efficiency savings are always the order of the day. He wants a fundamental review of public spending. He wants to see the level (in the economy) of government spending fall.

DARLING'S SUPPORT FOR INDUSTRY

This challenges Chancellor Darling's repeated argument for how UK industry has to be partnered by government to be helped, which he exemplified in a range of measures from reducing capital gains on small firms and raising personal allowances to active investment, credit. R&D, training, positive financial support measures for particular sectors, and raising capital investment allowance to £100,000 ad the capital gains tax threshold to £2 million.

WHERE CASH COMES FROM?

Bill Cash, Conservative MP, in his last speech in The Commons, emphasised that all government revenue comes from the private sector as part of his argument for shifting the boundary between private and public sectors. He said that this is an indisputable fact that even the government would not argue with. Cash is a very likeable and passionate about British sovereignty.

But, he is quite wrong. A lot of government revenue, roughly 28% (£200bn next year) is from taxing the public sector plus earnings from assets and liabilities that do not impact private sector tax or taxpayers' money. And, non-tax income in government revenue this year will be just over £50bn on-budget. Government will sell assets.

And then too, off-budget off balance sheet revenues will be much greater, and again nothing to do with tax. The idea that all government finances are taxpayers' money is not a fact, just dogma. Government has wealth and financial resources and they do not belong to taxpayers but to government itself, to The Crown. Private sector is not the only producer of national income. Government in the UK generates one fifth not counting those utilities and enterprises and non-profit bodies that are government owned, of which there are 86,000 all registered for VAT and subject to other taxes.

John Redwood made a valid point that he applied to government but should be aimed too at all parliamentarians that they must all do more to understand the scale of the economy, to gain a realistic perspective and sense of proportion. One of the first issues to begin with is understanding private sector debt before agonising about public sector debt, and then do more to understand how that is backed by assets and serviced by income, and then how productively the debt is applied.