When banks hit the rocks like ships caught in horrendous storms and governments have to send out the lifeboats and tugboats and the populace and shops are fearing for loss of jobs as trade suffers, and salvage operators circle like vultures, we are told that there are three questions potential investors in banks need to ask.

When banks hit the rocks like ships caught in horrendous storms and governments have to send out the lifeboats and tugboats and the populace and shops are fearing for loss of jobs as trade suffers, and salvage operators circle like vultures, we are told that there are three questions potential investors in banks need to ask. How much liquid capital is the sector going to need to refloat and stay afloat?

What will regulation do to normal EXPECTED earnings and borrowing and lending costs?

How is the economy when there is a drought in financing; should we fear deflation, another recession e.g. in EU and Euro Area, fall in world trade hurting China, Germany especially, asset bubble-burst recession in PR China, emerging market countries running higher deficits, world growth stuttering, etc?

Tidbits from the Group of 20 meeting, stress tests by banks, and what is being called Basel III new regulations for banks to build up larger buffer reserves to cover unexpected shocks (e.g. double-dip recession) and the US Congressional bill for financial reform (agreed without special tax levy on US banks of $19bn)and similar developments in Europe, may partially answer the first two questions. What is not answered by anyone convincingly is how the banks may be anchor-dragging on economic recovery because they continue to shrink their loan books. The truth is that many banks remain beached and the lending tide to refloat them and for them to refloat stangnating business remain out.

Tidbits from the Group of 20 meeting, stress tests by banks, and what is being called Basel III new regulations for banks to build up larger buffer reserves to cover unexpected shocks (e.g. double-dip recession) and the US Congressional bill for financial reform (agreed without special tax levy on US banks of $19bn)and similar developments in Europe, may partially answer the first two questions. What is not answered by anyone convincingly is how the banks may be anchor-dragging on economic recovery because they continue to shrink their loan books. The truth is that many banks remain beached and the lending tide to refloat them and for them to refloat stangnating business remain out. One has to wonder at the gall of banks such as the UK clearers who can say to Government boldly and on television that they are approving over 80% of business loan requests especially to small firms, when Bank of England survey data shows the figure is only 40%. Senior loan officers in several banks tell me the true figure is much below that, in fact banks are refusing 80% of loan requests! Are our bank managements knowingly telling lies or just ignorant of what is going on underneath them, or relying (as they often do) on some number that some bankers casually quote about a period of time long past and parrotting it as if still current because it sounds good. I suspect the latter.

One has to wonder at the gall of banks such as the UK clearers who can say to Government boldly and on television that they are approving over 80% of business loan requests especially to small firms, when Bank of England survey data shows the figure is only 40%. Senior loan officers in several banks tell me the true figure is much below that, in fact banks are refusing 80% of loan requests! Are our bank managements knowingly telling lies or just ignorant of what is going on underneath them, or relying (as they often do) on some number that some bankers casually quote about a period of time long past and parrotting it as if still current because it sounds good. I suspect the latter. In the USA, if this was the case Congress would erupt in anger, but nothing like that anger is so far occurring in among UK legislators, matters being left to Vince Cable leading an enquiry tour of the banks and the new Banking Commission enquiry. The HoC Treasury Select Cmte voted in (not appointed) may take a stronger line than hitherto. They could do no better than ask me for the facts. UK legislators are respectful toward banks even though the banks are not important sources of political campaign money. In the USA where firms can now donate any amount of money and it is an election year, legislators will still get very angry about the banks because this has strong public appeal, but may blunt their swords as in the banking reform bill. How much banks can rely on bribery or PR lobbying is therefore quite complicated. How much firepower can any sector have that remains underwater and in hock to government?

In the USA, if this was the case Congress would erupt in anger, but nothing like that anger is so far occurring in among UK legislators, matters being left to Vince Cable leading an enquiry tour of the banks and the new Banking Commission enquiry. The HoC Treasury Select Cmte voted in (not appointed) may take a stronger line than hitherto. They could do no better than ask me for the facts. UK legislators are respectful toward banks even though the banks are not important sources of political campaign money. In the USA where firms can now donate any amount of money and it is an election year, legislators will still get very angry about the banks because this has strong public appeal, but may blunt their swords as in the banking reform bill. How much banks can rely on bribery or PR lobbying is therefore quite complicated. How much firepower can any sector have that remains underwater and in hock to government?  For example, what should our politicians be thinking about the stark facts (among many I have collected) that German banks lend 16% of all non-financial customer loans to small firms, US banks lend 10%, while UK banks (domestically, including foreign-owned banks in UK) lend only 1.5% of all customer loans to small firms? Let us not forget that small firms employ half roughly of all private sector employees i.e. 40% of national totals.

For example, what should our politicians be thinking about the stark facts (among many I have collected) that German banks lend 16% of all non-financial customer loans to small firms, US banks lend 10%, while UK banks (domestically, including foreign-owned banks in UK) lend only 1.5% of all customer loans to small firms? Let us not forget that small firms employ half roughly of all private sector employees i.e. 40% of national totals.Governments, G20, EU, NGOs and various policy pundits, journalists and economic forecasters are torn between how urgently they want banks to cushion themselves with generous amounts of reserve capital and wanting banks to pump-prime recovery by boosting lending to key sectors such as small firms, manufacturing and business generally.

In 'credit-boom' economies like UK and Spain and Greece there is also some pressure on banks also to resume mortgage and property development lending even if this will not help narrow trade and payments deficits. Central banks in Spain and Greece will resist this, but the UK is uncertain given the continuing housing shortage.

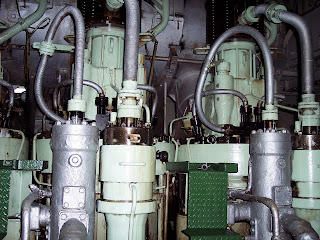

Governments are also committed to no more banking shipwrecks. But banks are making way in stormy seas, some more powerfully than others, but all are variously interdependent, netyworked. Shipping, for example, is transport, a transmission mechanism like banks, exposed on the ocean waves of the world economy, but dependent not on their own power so much as on the tides, currents, and world economic system. It is not part of regular business management thinking, however, to see firms as part of the global system, but only as succeeding or failing by whatever they do for themselves. This is only half of the truth. The other half is what banks, governments, business science and poltiics have most difficulty coming to terms with. Why because there are too many variables for them to compute, and they do not have the geostationery guidance systems yet to make sense of all of that. We should not be surprised therefore when "every man for himself" is the repeated kneejerk response to systemic panic.

Those fearing another bout of embarassing losses among banks as they unwind their Credit Crunch spaghetti of inter-linkages, and start to count up realised losses after recoveries and collateral disposals, want banks to hold enough tier one capital to withstand another financial crisis as big as the last one. It is actually similar to requiring banks to carry enough water to refloat themselves like ships off the rocks, or like BP must have enough capital to pay all damages and clean-up costs of the Gulf of Mexico disaster. Yes, but what is the next Credit Crunch is more like ships in a desebanks to refloat off the reefs without government support. In my view this is foolish thinking for two reasons:

Those fearing another bout of embarassing losses among banks as they unwind their Credit Crunch spaghetti of inter-linkages, and start to count up realised losses after recoveries and collateral disposals, want banks to hold enough tier one capital to withstand another financial crisis as big as the last one. It is actually similar to requiring banks to carry enough water to refloat themselves like ships off the rocks, or like BP must have enough capital to pay all damages and clean-up costs of the Gulf of Mexico disaster. Yes, but what is the next Credit Crunch is more like ships in a desebanks to refloat off the reefs without government support. In my view this is foolish thinking for two reasons:1. banks would have to hold three times minimum regulatory capital i.e. 24% ratio to risk-weighted assets, and

2. government bailing out of banks is very cost efficient and over the medium term profitable to taxpayers.

Credit Crunch was like ships suddenly finding themselves in extreme ebb tides straned in a desert of all liquidity sources dried up so that they could not refinance their funding gaps and stock markets withd more negative liquidity (shorting and panic selling) than positive liquidity (long term investors). Government had to step in and water the desert or dig channels and drag the hulks back to sea. Authorities (of all kinds), however, are now urgently keen to see governments disengage from bank aid-packages and to sell stakes in banks as soon as possible, to return all matters to private markets, and this against a background of a Greek Chorus chanting "let banks fail, no more moral hazards" (including some banks such as Banco Santander and HSBC and others' related views).

Credit Crunch was like ships suddenly finding themselves in extreme ebb tides straned in a desert of all liquidity sources dried up so that they could not refinance their funding gaps and stock markets withd more negative liquidity (shorting and panic selling) than positive liquidity (long term investors). Government had to step in and water the desert or dig channels and drag the hulks back to sea. Authorities (of all kinds), however, are now urgently keen to see governments disengage from bank aid-packages and to sell stakes in banks as soon as possible, to return all matters to private markets, and this against a background of a Greek Chorus chanting "let banks fail, no more moral hazards" (including some banks such as Banco Santander and HSBC and others' related views).  The idea is that when assets are underwater banks should have enough compressed gas in their recovery balloons to lift the sunken wrecks back to the surface for repair and recovery. My three times regulatory capital estimate was recently confirmed by the FT commenting, "For months now banks have been worried because if “support” includes all benefits from implicit taxpayer guarantees – for example the ability to generate a high return on equity from excessive leverage and a lower cost of capital – banks would require more than three times today’s level of equity capital to compensate, according to some studies." (i.e. mine.)

The idea is that when assets are underwater banks should have enough compressed gas in their recovery balloons to lift the sunken wrecks back to the surface for repair and recovery. My three times regulatory capital estimate was recently confirmed by the FT commenting, "For months now banks have been worried because if “support” includes all benefits from implicit taxpayer guarantees – for example the ability to generate a high return on equity from excessive leverage and a lower cost of capital – banks would require more than three times today’s level of equity capital to compensate, according to some studies." (i.e. mine.)But if support simply means covering losses, US banks have tier one capital to cover gross losses up to $1,200bn. Yes, but then they must rapidly replace that capital or they are insolvent. Net losses, would be half this or less, but they take a few years to confirm i.e. $1.2tn gross capital replacement that become $600bn net. In Europe the figures are similar but larger i.e. $2tn and $1tn.

Many may argue this thinking is too lax. But if new Basel capital adequacy standards eventually follow the G20’s lead, a big worry for potential investors, banks will require half as much again in liquidity reserves. How do they do this? They have to sell off some operating units, non-core assets, asset management and insurance, and reduce their own portfolio capital for trading. In my view this is taking defensive thinking too far and too abstractly. The general concern is to stop banks building up asset bubbles again. This is a symptom and in some sense what always has to happen anyway. It is more vital to consider the matter less abstractly and more in terms of how banks are risk diversified. Banking has gone too far in containerisation to only see the portfolio boxes and loans in the abstract and not what is inside the portfolios, inside the many same shape containers.

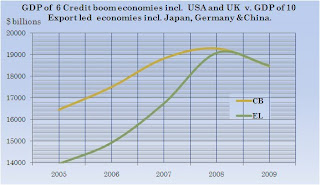

In my view it is far more important that banks rebalance their loan portfolios so that they are much better risk diversified across all sectors of the economies where they operate. In export led economies like Germany and China banks lend two third to business, directly and indirectly (via loans to other financial firms), while in credit-boom economies banks are lending more than two thirds to mortgages and property. These extreme biases lie at the heart of extreme imbalances in the world that were the ultimate original cause of the Credit Crunch.

In my view it is far more important that banks rebalance their loan portfolios so that they are much better risk diversified across all sectors of the economies where they operate. In export led economies like Germany and China banks lend two third to business, directly and indirectly (via loans to other financial firms), while in credit-boom economies banks are lending more than two thirds to mortgages and property. These extreme biases lie at the heart of extreme imbalances in the world that were the ultimate original cause of the Credit Crunch.Market analysts are incapable of looking at the macroeconomic picture. It is above their pay rate. They are tasked to be obsessed with how big a dent to banks' net interest income profits in the short to medium term that financial reform may make? It is impossible to know for sure; the answer is certainly less than feared, but analysts have to come up with some numbers. Hardly a day goes by when some analysts from a bank or fund management does not call me to ask the same question “what will the impact of “Basel III” new regulatory requirements on banks’ profits?

One big last-minute change to the Congress's derivative legislation, for example, allows banks to keep trading interest rate and currency swaps in-house (81% of swaps by gross notional value according to BIS). Another change relaxed the expected restriction, slightly, on banks’ lending and investment in private equity and hedge funds: US banks may expose 3% ratio to tier one capital to AI and Hedge funds.

A bigger question is whether big banks may yet be split between traditional retail and investment wholesale banking? Canada plays a key role here as an example where banks avoided the worst of the Credit Crunch despite having also ended their Glass-Steagal type division between retail and investment banking at the same time as US and UK, which to many observers is like the difference between merchant ships and navy vessels.

Implementation periods for implementing new capital reserve build-ups have also been stretched out and important definitions – such as the language around proprietary trading – still leave room for manoeuvre, just as there also remain foggy fudging of fair value, stress tests and other issues in Basel II and IFRS.

Implementation periods for implementing new capital reserve build-ups have also been stretched out and important definitions – such as the language around proprietary trading – still leave room for manoeuvre, just as there also remain foggy fudging of fair value, stress tests and other issues in Basel II and IFRS.In all, analysts reckon normalised earnings per share could be anywhere between about 5 and 15% lower for universal banks in the USA, and 10-15% lower for the brokers such as Goldman Sachs and JP Morgan, with mid-single digit declines for regional and trust banks. This will be similar if applied in Europe. All that changes however if the Euro Area falls apart, if there is an EU recession and if Far East markets, especially China, and emerging markets go into a tailspin.

Forget the charges such as the surprise recoiling from applying a $19bn fee to offset the cost of the new US bill, or Bank Stabilisation Funds in Europe and other bank taxes – investors will look through one-offs for valuation purposes. The most important reforms are the move to trade and clear derivatives on-exchange, the possible death of certain swap desks, and the ultimate re-definition of proprietary trading in terms of limits as well as accounting under IFRS, and the debasement in Europe of ratings agencies. These and related matters could yet contain some shock surprises.

But the potential for damage to shareholders is limited in the case of long term investors. The problem is that short term profit hunters, brokers, “day traders” and stock-shorters continue to dominate as can be seen in market volatility. Even if these regulations pull down net profits by 20%, compensation would only have to fall by a tenth to match the decline. This assumes the recent relationship between revenues and profits stays about the same and 40% of operating revenues continue to be paid to employees, including bonuses. And it excludes the inevitable impacts in the finance sector of new tradable instruments.

But the potential for damage to shareholders is limited in the case of long term investors. The problem is that short term profit hunters, brokers, “day traders” and stock-shorters continue to dominate as can be seen in market volatility. Even if these regulations pull down net profits by 20%, compensation would only have to fall by a tenth to match the decline. This assumes the recent relationship between revenues and profits stays about the same and 40% of operating revenues continue to be paid to employees, including bonuses. And it excludes the inevitable impacts in the finance sector of new tradable instruments. Other factors that analysts are blind-sided by include the need of all banks to modernize (replace not upgrade) their general ledger systems and to incorporate a new generation of risk accounting systems. Naming no names, the current state of banks’ back office systems, GLs and risk engines is appalling. Many banks lack systems for risk accounting of loan collateral, some have only a dozen or less credit risk counterparty types, or less than 20 major GL headings, or subjective intuitive ratio inserted here there and everywhere. No banks are free of bug fixes that generate more system bugs, or, for example, account numbers that may be the same for different customers in different branches, and all big banks have complex networking of systems between tottering opaque legacy systems, outdated versions, impossible to scale up, historical data breaks between systems, held together with duck tape and chewing gum and new ones that lack modular design or have impossible interfaces and on and on. The cost of replacing system in any big bank runs into $billions and by the time they are implemented, assuming efficient, experienced professional teams are available, they will be out of date.

If stress tests applied to banks’ accounting systems, both cash accounting and risk accounting, as Basel II proscribes, they would almost all fail. It is a great irony that regulation requires certifying and externally validating everything, yet computer systems that in the end are what express and safeguard everyone’s finance, are not required to be certified. Auditors ought to be doing this, but of course cannot and would not do so thoroughly. Therefore, there should be regulatory supervisor agencies set up specifically to audit banks’ financial computing systems.

If stress tests applied to banks’ accounting systems, both cash accounting and risk accounting, as Basel II proscribes, they would almost all fail. It is a great irony that regulation requires certifying and externally validating everything, yet computer systems that in the end are what express and safeguard everyone’s finance, are not required to be certified. Auditors ought to be doing this, but of course cannot and would not do so thoroughly. Therefore, there should be regulatory supervisor agencies set up specifically to audit banks’ financial computing systems.According to a Credit Suisse analysis, a team I admire above many others, the estimated impacts of the new so-called Basel III proposals are very material for European banks. The revisions will reduce tier 1 capital to 2.6% and require €600bn- €1,000bn of new capital for European banks to comply with minimum capital proposals. That assessment seems harsh, but is caveated by taking existing data and not assessing the impacts over time, over say 3-5 years. The liquidity provisions will require €3,500bn-€5,500bn of new long term funding. This I also find to be several times too large, but must bow to the fact that my view is intuitive wheras CS has done the math. Finally, the impact on European bank earnings is estimated at €250bn (equivalent to 37% of 2012 earnings), with a drop in return on equity of 4% to 5%.

Interesting then that in the UK and elsewhere there are many groups hovering in the wings anxious to cherry-pick banking assets and to buy existing banks, parts of them, or set up new ones. Maybe they are the only long term investors making an impact on the banking sector; not the short-term bonus-motivated current generation of bankers.